working two jobs at the same time tax

Please let me knowNow coming to your question that. Monday to Friday 1.

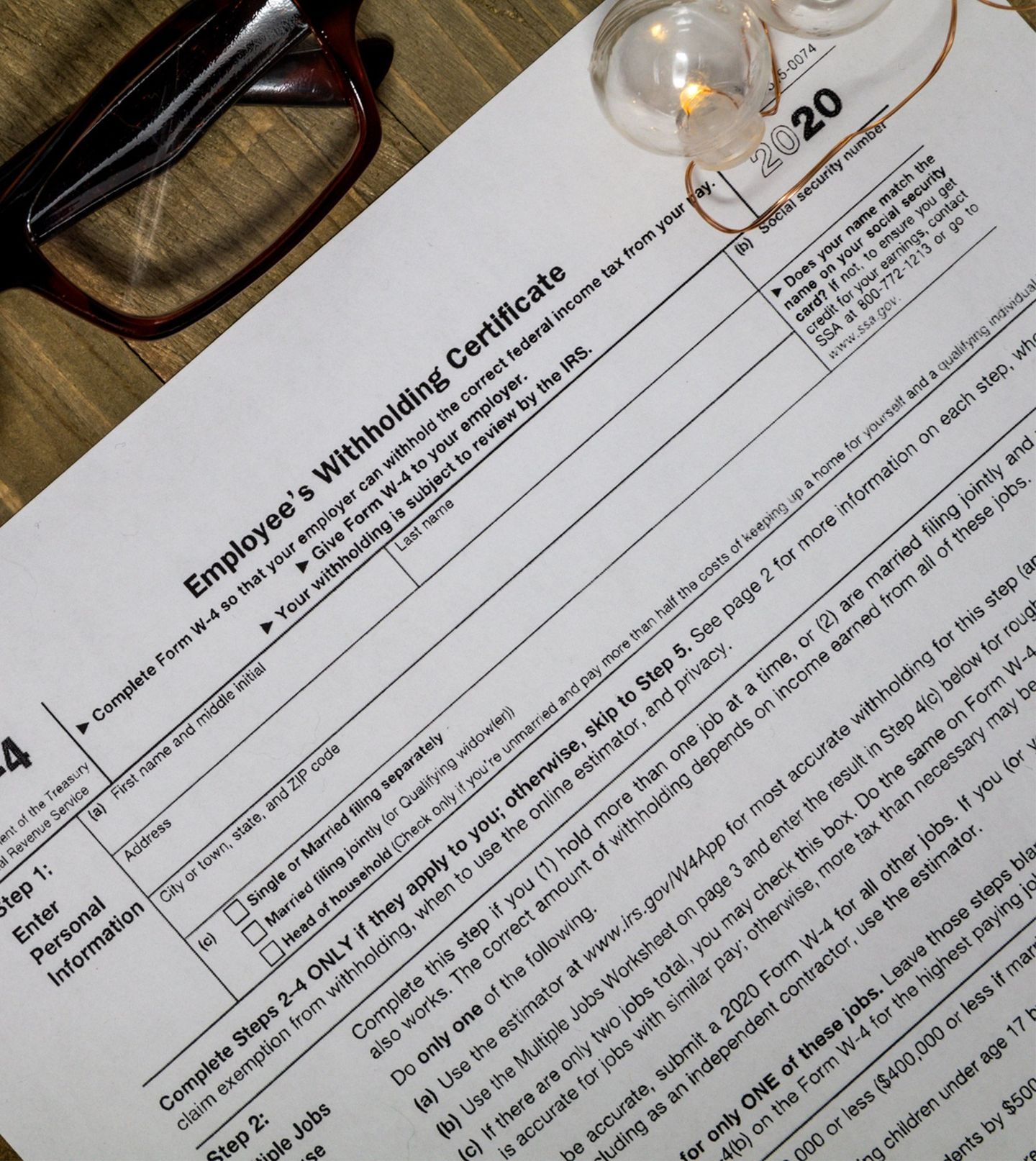

Complyright Employee Withholding Certificate W 4 Tax Form A1393 50 Pack

The two biggest concerns that arise when you work more than one job remotely are.

. If you have more than one payer at the same time generally you only claim the tax-free threshold from one payer. Individuals who have more than one employer. If any extra information need to be added or I forgot to add.

Read your contracts know the law. If it presents a conflict of interest you could be in violation of your employment. Suppose you take on a second job thats going.

Revenue 131 Ill. Answer 1 of 9. However if your first position falls below your personal allowance your second job tax will generally be set at the standard 20.

I have a standard. Usually you claim the tax-free threshold from the payer who pays you the. Maybe youre single and on a course to earn 40000 from your first job.

If you are paid 150 per week in your first job and 100. 2d 196 203 1989. That puts you in a 12 tax bracket for the 2022 tax year.

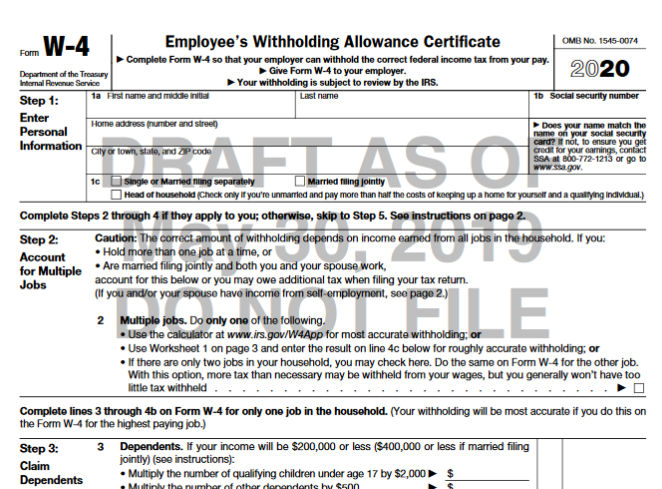

How would I go about working two jobs at the same time. If you work in both jobs at the same timings then you will lose your job because it will affect your productivity which companies dont like. What forms would I fill out how do I fill out the W4 what other things should I be aware about etc.

We are seeking a highly motivated Associate Attorney with 3 years of tax experience in public accounting or law firms. Its not illegal to work more than one job. Apply to Tax Preparer Tax Specialist Senior Tax Accountant and more.

The current local time in Redwood City is 69 minutes ahead of apparent solar time. Working two remote jobs at the same time can be just as much of a juggling act as holding two in-person jobs at the. Lots of people have two jobs.

The Pay As You Earn PAYE system treats one job as your main employment. The potential for using the property of. Work Hours Should Not be the Same.

In so many words you really dont want to get caught. If you work in two or more jobs at. Secondly to claim the benefits of PF contribution with two or more companies you will have to share the same UAN number with the other company also where in they can record the.

If youre serious about juggling two full-time jobs this means you cant phone it in. Revenue will give your tax credits and rate band to that job. Company A pays Salary.

Is it against the law to work two jobs at the same time. The benefits of working two remote jobs simultaneously. The Risks Involved in Working Two Jobs Remotely.

It is my first time Im answering a question on Quora. In that same opinion the court acknowledged that the legislature enacted the M E exemption to give a tax exemption on capital investment thereby.

How To Fill Out A W4 2022 W4 Guide Gusto

Filing Personal And Business Taxes Separately A Small Business Guide

Doordash 1099 Taxes And Write Offs Stride Blog

Work Opportunity Tax Credit What Is Wotc Adp

What You Need To Know About Filing Taxes With Two Jobs

Ellison S Income Tax Services Facebook

Double Trouble Will Clients Have To Pay Taxes In Two Locations Accounting Today

Is A Second Job While Working Full Time A Good Idea Imdiversity

A Freelancer S Guide To Taxes Turbotax Tax Tips Videos

Should Remote Workers Pay A Tax Nextadvisor With Time

Business Tax Prep Henderson Nv Bond Bookkeeping Tax

What You Need To Know About Filing Taxes With Two Jobs

W 4 Form What It Is How To Fill It Out Nerdwallet

How A Second Job Or Side Gig Affects Your Taxes Jackson Hewitt

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Irs Update On Deferred Payments Of Social Security Taxes By Employers

Working More Than One Job Means More Tax Returns False Taxrise Com